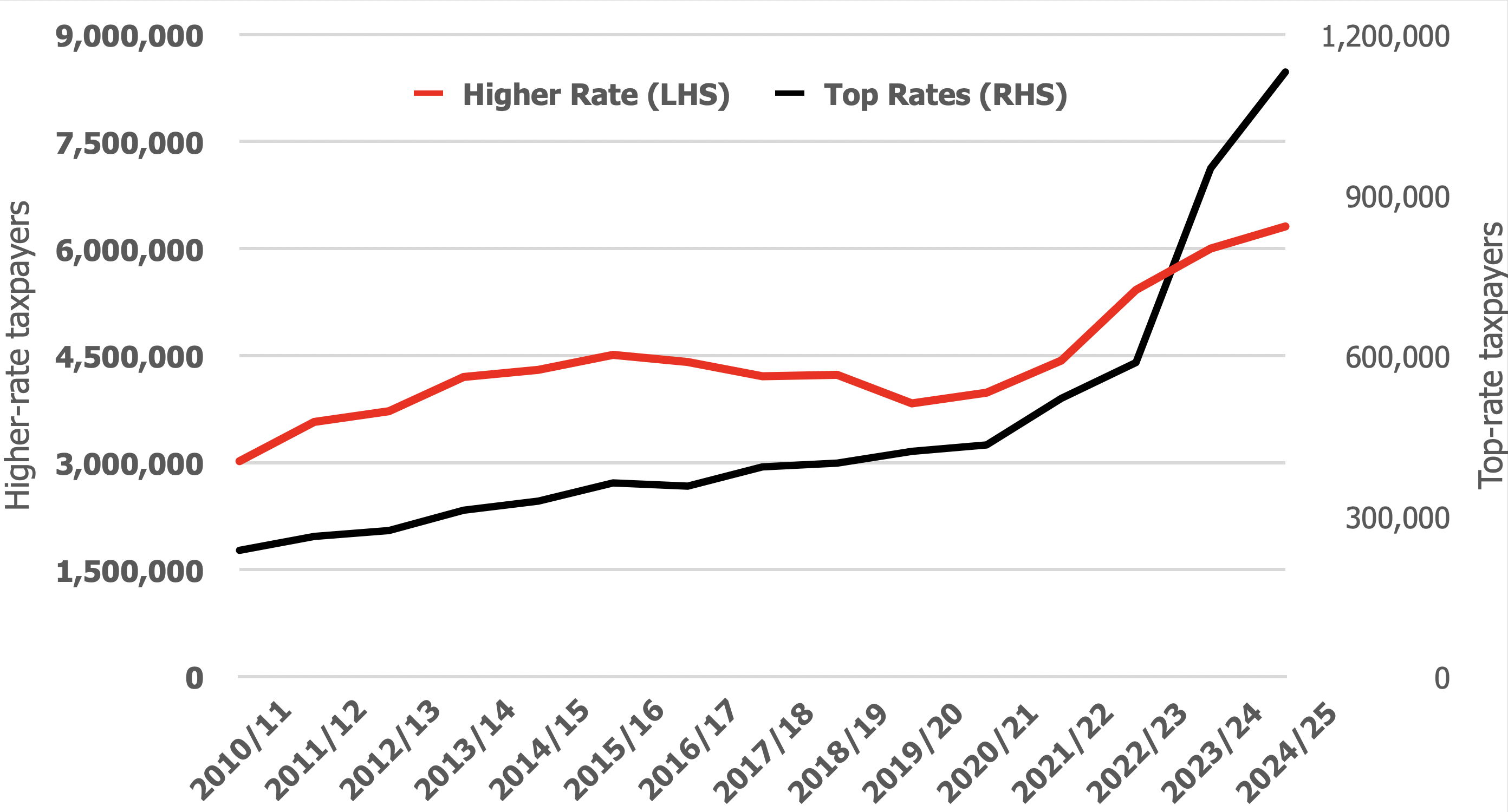

Joining the boom in top-rate taxpayers?

New data from HMRC show there are now more than a million people paying income tax at a rate of at least 45%.

Source: HMRC

Each year HMRC produces an extensive set of tables about income tax, the source of about 30% of all revenue flowing into the Exchequer. The stats that caught media attention show how many taxpayers are paying more than basic rate (see graph above).

Scotland complicated these tables several years ago by creating 19% and 21% rates alongside the 20% basic rate. In the current tax year, a further complication has been thrown into HMRC’s spreadsheets by the introduction of another Scottish tax rate, the 45% advanced rate. This applies to taxable income (excluding dividend and savings income) between £62,430 and £125,140, the starting point for Scotland’s top rate (increased to 48% for 2024/25). The rest of the UK applies additional rate tax (at 45%) from the same upper level.

Faced with multiplying tax bands, HMRC decided that it would class anyone in the UK paying tax at 45% or more as an additional-rate taxpayer. This pragmatic approach had two consequences just about detectable on the graph above:

- The number of Scottish higher-rate (42%, not 40%) taxpayers fell 11% because some became advanced-rate payers.

- Scottish additional-rate taxpayers increased by 253%.

Hike in numbers

The Scottish distortions were not sufficient to alter two clear trends in the graph: a sharp rise since the start of this decade in the number of UK taxpayers who pay higher rate or additional rate (as HMRC defined) tax. The boom in the higher-rate taxpayer population is a direct result of the freeze in the higher rate threshold at the 2021/22 level (throughout the UK), despite the 20%+ surge in inflation since April 2021.

The additional-rate tax story is worse because a £150,000 threshold freeze from 2010/11 was followed by a cut to £125,140 in 2023/24 (and the Scottish ‘advanced’ manoeuvre in the following tax year).

The higher-rate threshold freeze is currently due to end in April 2028, although it is possible that October’s Budget will extend the date – as previous Chancellors have found, threshold freezes are a useful stealth tax increase. The additional rate threshold is fixed, with no prospect of change until a Chancellor decides to act. Suffice to say, such generosity to those with the highest incomes is not top of anyone’s political agenda.

At the time of the last Budget, the Office for Budget Responsibility estimated that by 2028/29 nearly one in five income taxpayers would be paying higher rate and more than one in thirty would be subject to additional rate.

If you find yourself in, or heading to, higher- or additional-rate tax, it is unlikely any Budget in the next few years will come to your assistance. If the proportion of your income lost to tax in the future reduces, it is much more likely to be the result of careful personal tax planning than any Chancellor’s largesse. To find out more about the range of those planning options and the tax savings you could make, please get in touch.

PLEASE NOTE:

The Financial Conduct Authority does not regulate tax advice. Tax treatment varies according to individual circumstances and is subject to change.